From an industry perspective, Oil & Natural Gas Industry is divided into three major sections.

- Upstream

- Midstream

- Downstream

Upstream companies are engaged in the exploration and production of crude oil. Downstream companies are involved in the refining of crude oil and the selling and distribution of natural gas and products derived from crude oil. Midstream companies link upstream and downstream and includes transportation and storage services.

Upstream companies around the world sell their crude oil to downstream refining and marketing companies of different companies based on international crude oil prices. So the revenue flow is of Upstream companies that are directly related to international prices. Thus lower prices are negative for Upstream companies and good for Downstream companies. Their revenues will immediately take a hit if the oil price continues to fall.

Brent Crude, used by Upstream companies is suitable for the production of useful products such as petroleum naphtha, gasoline, diesel fuel, asphalt base, heating oil, kerosene, LPG, jet fuel, and fuel oils. That is why is it used to determine the value of 60% of oil on international markets and it is a major trading classification and serves as one of the two main benchmark prices for purchases of oil worldwide.

14 oil-producing nations. (including Saudi Arabia) founded an alliance on 14 September 1960 in Baghdad Called OPEC (The Organization of the Petroleum Exporting Countries) so that they can control and decide the oil price in the world and stay profitable simultaneously. In 2016 Russia and other 9 countries also joined OPEC and named it as OPEC+. Now, this OPEC+ (a group me 24 countries) was handling 55% of the total oil supply in the world.

Currently, the top three oil-producing countries in the world are Saudi Arabia, Russia, and the USA. (The USA is now acting as the competitor of OPEC+ because it is still not a part of OPEC+ countries.)

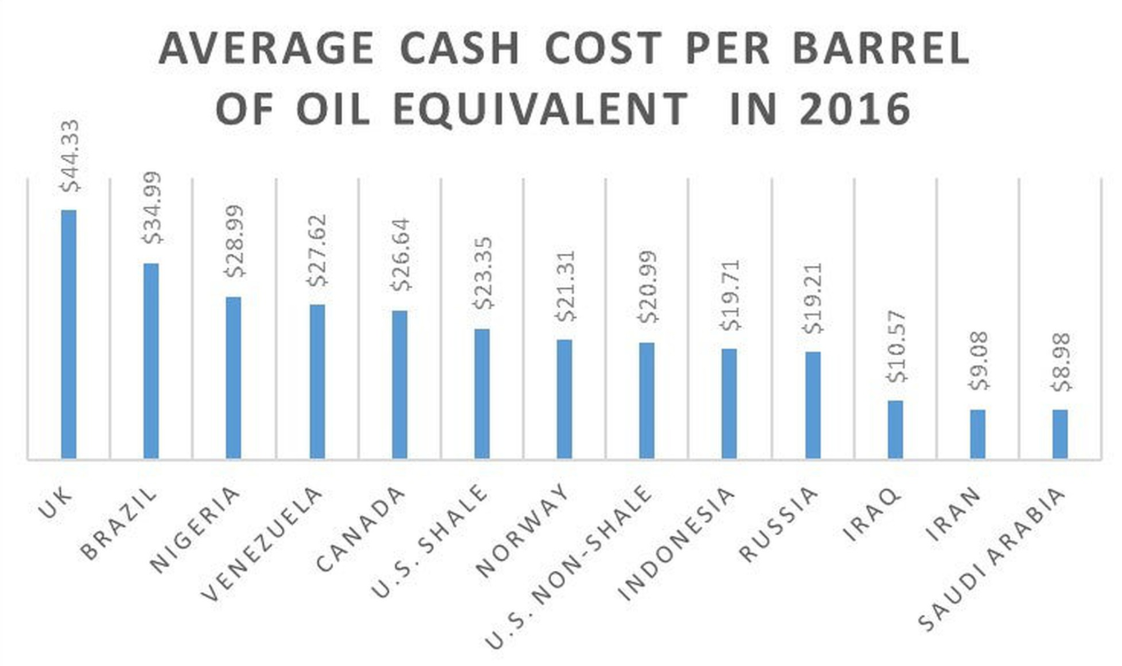

All three countries want to sell as much oil because their production cost is much more lessor that you can’t even imagine.

Before Coronavirus pandemic, everything was normal as Brent was trading at $60–70 per barrel and these oil-producing countries were highly profitable.

For example, Saudi Arabia has a production cost of $8.98 and they are selling at $60 per barrel and making 500% profit per barrel.

During the Coronavirus pandemic, many countries declared complete lockdown so road transportation, airlines, shipping, factories, colleges, offices, etc were shut and oil demand decreased and Brent crude price started crashing. Many countries got worries because if it breaches their production cost (see Figure 1) then all companies will be running in losses and few of them would shut down.

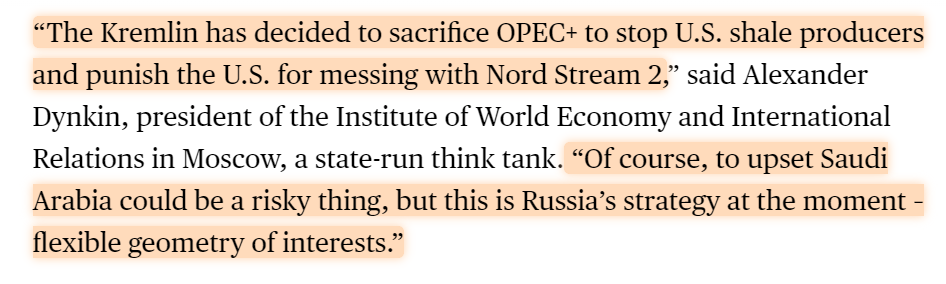

If the demand is decreasing then the only way to stabilize crude price is to cut the production and supply would be in line with the demand. So, on March 05, OPEC+ held a meeting to cut down the oil supply by 1.5 mn barrel per day, so that oil prices must be stable and every country should stay profitable. Russia denied the decision and on the contrary Russia increased production and broke the alliance of OPEC+.

Result? Oil price crashed to $15 per barrel from $50 per barrel due to more supply and less demand.

Although Russia is less dependent on oil sales to fund their national budgets, But the question is why Russia didn’t agree to cut the production when they knew that by doing so, they will vanish the profitability of other countries including Russia itself?

Because Russia wants the USA to shut down oil production so that Russia and Saudi Arabia may continue to stand as the top two oil-producing countries in the world.

USA has always been an oil-importing country like India, China or Japan but after the Shale Energy revolution in 2011, it became the world’s biggest oil producer overtaking Saudi Arabia and Russia and ate their market share. By using this technique US started increasing the supply of oil and oil prices started tumbling which ultimaterly hit the profitibility of Russia and OPEC.

Russia was thinking that by increasing oil production, supply would be much more than the demand the oil price would crash and the Shale Energy Revolution in the USA won’t survive due to higher production cost.

Since private companies handle oil drilling operations in the US so when they go bankrupt due to higher production cost the US government companies won’t come to rescue them, after all, they are private companies. Later when USA oil drilling companies would shut down then they (Russia and OPEC) will take back their market share, Increase the oil price and post higher profitability. So, Later Saudi Arabia followed the same path and increased oil production.

Overall Impact: If the oil price continues to sustain at a lower level then it is possible that the strategy may work and small oil drilling companies in USA may shut down due to higher production cost but big companies may be rescued by US Government. In Russia and Saudi Arabia, oil drilling companies are handled by the government so they continue fund it and companies may sustain in the short term but if oil levels continue to remain at lower levels then Russia won’t sustain.

Today (10 Apr, 2020) OPEC, Russia and other countries agreed temporarily cut production by10 million barrels a day (about 23% of their production levels) in May and June. It would be interesting to see how brent crude prices and associated companies would react.

Let’s talk about India

The Oil and Gas Industry in India constitutes over 15 % of the GDP. In addition, it serves as the backbone for transportation and hence affects the performance of many other industries such as infrastructure, cement, construction, aviation, tyre, etc.

India the fourth-largest consumer of oil and petroleum products in the world. As per estimates, Energy demand is projected to touch 1,464 million tonnes of oil equivalent (Mtoe) by 2035 from 559 Mtoe in 2011. Furthermore, the country’s share in global primary energy consumption is anticipated to double by 2035.

Major Players in the Oil and Natural Gas Sector in India

- Oil and Natural Gas Corporation Limited (ONGC)

- ONGC Videsh Limited

- Oil India Limited

- Reliance Industries Limited

- Cairn India Limited (A Vedanta group company)

- Indian Oil Corporation Limited

- Bharat Petroleum Corporation Limited (BPCL)

- Hindustan Petroleum Corporation Limited (HPCL)

- GAIL (India) Limited

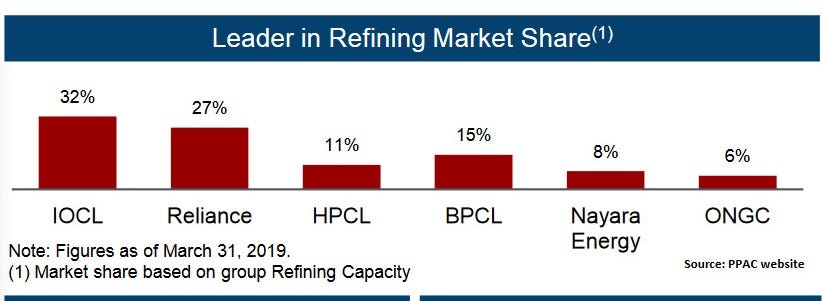

ONGC is the largest upstream company dominating the exploration & production segment and Indian Oil Corporation is the largest state-controlled downstream company with 32% market share.

Impact of lower Crude Prices in India

This is interesting, India has always been a net importer of Oil & Natural Gas as it imports more than three-fourths of its requirement of crude oil from the Middle East particularly from Saudi Arabia and Iraq.

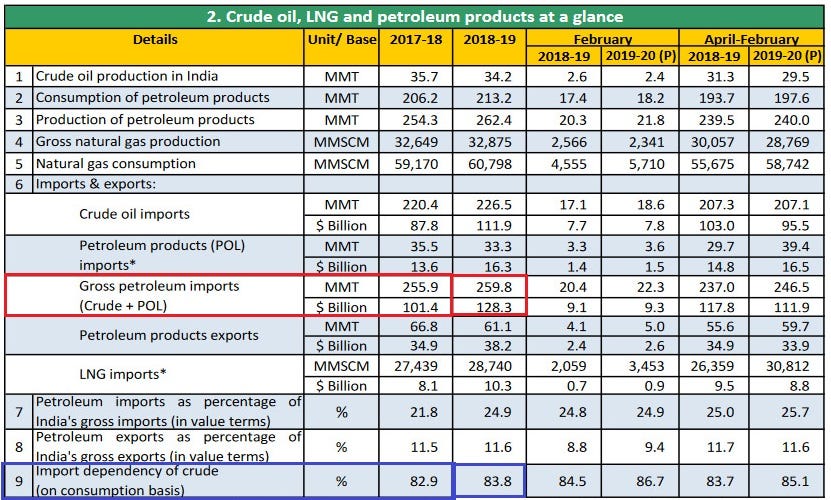

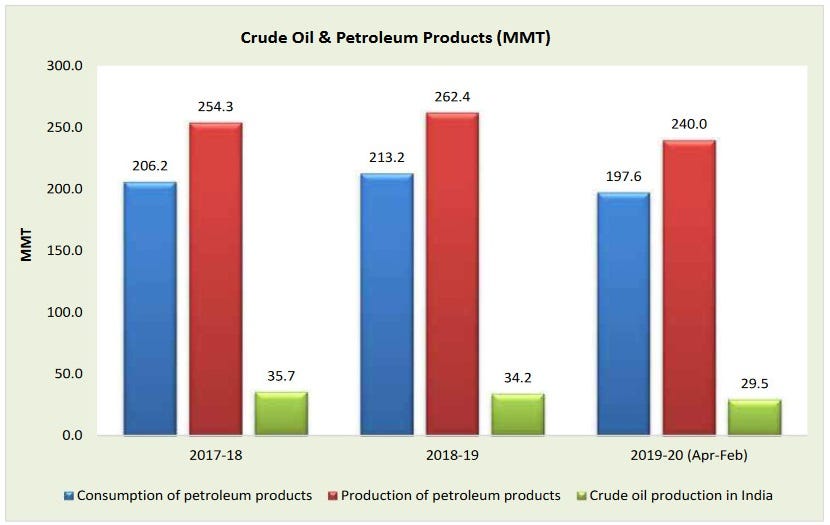

See the chart below (Latest data)

India spent $128.3 bn for importing crude and petroleum products (red box) which constitutes 24.9% of the total import bill. Almost 83.8% of crude requirements India imports (blue box). In the diagram below you can compare the production & consumption.

- Biggest beneficiaries of low crude price: Indian government and downstream companies would be the biggest beneficiaries because India still imports 80% of its crude requirements so India’s oil import bill may halve to $62 bn from $128 bn if current crude price holds. The government may use it to fill the gap of deficits. Downstream companies (like GAIL, IOCL, RIL) would be happy to buy their raw material (Brent crude) at a much lower cost.

- Biggest losers of low crude price: Upstream companies like ONGC, Oil India. Being a play on crude oil prices and with Brent crude trading below $30 a barrel, ONGC and Oil India may not be in a position to recover their cost of production. ONGC’s cost of production will be close to $31 a barrel; for Oil India, it will be $25–26 a barrel. Thus, if oil prices remain at the current levels, the companies may even end up posting a loss at the pre-tax level.

The requirement by government-owned companies to pay a minimum annual dividend equal to 5% of their net worth or 30% of their net income (whichever is higher) would also be seen as a negative for companies because they are already in stress due to lower oil prices.

Ex- ONGC’s cash and cash equivalents declined to Rs 6,700 crore on September 30, 2019, from Rs 24,700 crore at the end of 2016, while its net borrowings increased to about Rs 1 trillion from Rs 21,500 crore during the period.

Next time, when the price of Brent crude falls, buy downstream companies and when the crude price is expected to surge then go for Upstream companies.

I hope it was informative.

Join Free Marketnotes telegram channel to get more useful articles and best viral stories straight into your inbox: Join here

Akshay Seth

Linkedin